Summer of Tariffs: Q&A with Glenn

Part two of our series about the new tariffs.

This blog post serves as the next step in SparkFun’s conversation with its customers and business partners to answer additional questions about the impact of tariffs.

On July 6th, Section 301, list one, of President Trump’s tariffs took effect valued at $35B with a duty rate of 25 percent. This date marks the beginning of a series of decisions that SparkFun, our business partners and ultimately our customers will need to make as a result of these tariffs. In this blog post, I’d like to address additional questions related to the tariff impact on our business and the industry at large.

If companies cannot find a solution to the components impacted, such as alternative sourcing or offshore manufacturing, those additional costs (if material) will ultimately trickle down to the consumer no matter where that additional cost is incurred in the supply chain.

Some conversation in the media suggests that tariff costs will get lost in the wash by the time they reach the consumer, but it would be irresponsible for any business to fail to quantify the increase in their cost of goods as a result of the new tariffs. Since many of our customers and business partners purchase at the component level, they will likely feel the impact, as we explained in last week’s blog post.

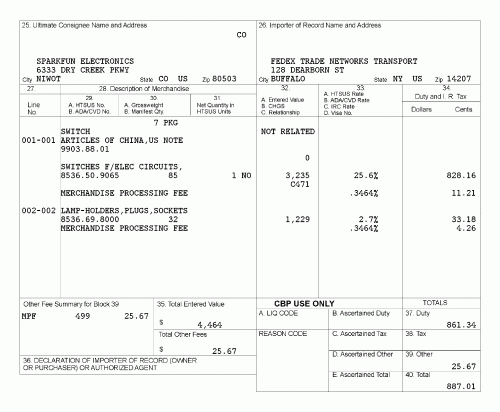

SparkFun’s first new tariff

We received our first imposed tariff charge less than one month after the effective date. For this order, we are the importer of record so we can easily identify the tariff charge. In cases where we are not the importer of record, this will vary from partner to partner.

Captured under HTSUS Subheading 8536.50.90, this particular tariff applies to switches making connections to or in electrical circuits for voltage not exceeding 1,000V. If you are curious and want to get a sense of the scope of the first list, feel free to review the document from the USTR. You can clearly see what the tariff charge is here:

Will a 25 percent tariff be material on a single switch purchase costing a few dollars? Of course not. But this helps illustrate that once you start entering into the hundreds and thousands of dollars, these tariffs begin having an impact.

Common questions from our community

Will SparkFun be finding new suppliers in countries other than China?

Switching suppliers presents risk to manufacturers because of the benefits of these longstanding and reliable relationships. Any possibility of reduced communication from our suppliers or decreased predictability can have consequences that are amplified through each phase of bringing a product to the storefront.

A single shipment of a single small part from a supplier could affect dozens of our storefront SKUs and prevent us from keeping essential products in stock for our customers that need them. Additionally, changing suppliers would inevitably force many product redesigns.

In the short term, we are not looking to change supply chain partners for many of the reasons mentioned. But as time goes on, alternate sourcing will become a bigger priority for our supply chain team.

How do the tariffs impact how much SparkFun manufactures in the U.S.?

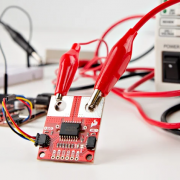

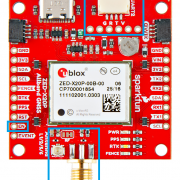

SparkFun has always been committed to making goods here in America. In fact, 100 percent of our SparkFun products are manufactured in the U.S. We manufacture well over 400 SKUs in-house, many of which represent products with the highest run rates. In a fast-paced business like ours where we have new products introduced every week, there is a strategic advantage to having our talent in R&D, Product Development and Manufacturing all under one roof.

Over the long term, these tariffs put SparkFun at a disadvantage from a manufacturing standpoint. If tariffs continue to expand and stay intact, it will benefit our business to move a portion of our manufacturing to other countries that provide a cost advantage and where components are not impacted by the tariff. But we are way too early to even consider this at this stage. Even if this Tariff situation turns into a long game and forces a decision like this, we will always be committed to manufacturing our new products in the U.S. for all the strategic reasons stated above.

For companies that currently have manufacturing capabilities (or partners for that matter) both in Mexico and the U.S., I suspect you’ll start seeing shifts to manufacturing in Mexico. Beyond avoiding the tariff charges, companies will not want to risk their supply chain relationships that are dependable and likely provide value beyond the parts.

How much will prices increase?

This will vary from product to product. We are so early in this process that suppliers haven’t completely communicated how this will impact things on their end. This, unfortunately, is a wait and see, but don't assume a 25 percent increase across all set of products impacted by the tariff. We suspect the range of increases for the products affected will be anywhere between two and 25 percent.

The most impacted will be the resale items in our catalog. Resale items are a component or product that we resell without any alteration. Our boards manufactured in the U.S. will see less of a hit, but this can change very quickly if the administration begins including IC’s as part of the tariff.

Will SparkFun change its product mix to reduce tariff costs?

The short answer is no. The team will continue to bring products to market that we believe our customers want. If there’s a scenario where a unique part is only manufactured in China, we will continue to make it available and see if the market tolerates the price changes. If the product does not sell well, we will discontinue as we normally would.

What parts will be impacted?

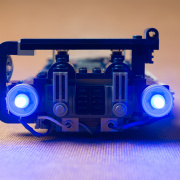

Connectors, switches, resistors, sensors, assembled PCBs from China and LEDs will be most impacted.

What do you consider to be the biggest challenge?

SparkFun will manage through the changing market conditions as it always has. I am not worried about the short term challenges this is creating.

What will become challenging is if trade policies continue to change and create a long-term uncertainty in the markets impacted. Companies will not make commitments in terms of time, money or other resources in an environment of uncertainty. Until regulatory changes settle down and some measure of predictability and steadiness characterizes our market again, our pursuit of alternative sourcing, increasing or decreasing manufacturing the U.S., or exploring new markets or technologies will be somewhat diminished in scope and prioritization.

Ask us questions

We remain committed to transparency with our community and look forward to working with our customers and partners as we transition to this new regulatory environment. Our next steps as an organization are to responsibly quantify the cost impact of tariffs across our catalog, and balance the needs of our suppliers, customers and employees while continuing to manufacture as much of our catalog as possible in Colorado.

We would like to invite our customers and business partners to reach out to us via our Facebook or Twitter pages, or in the comments below, with any questions or concerns regarding tariffs, product pricing or stock rates.